COMPANY HISTORY

1. Creating a world famous brand and listing on the Shanghai Stock Exchange

The predecessor of Qingdao Haier Company was Qingdao General Refrigerator General Factory established in 1984, and the offering was approved by the Qingdao Branch of the People's Bank of China on December 16, 1989, which was offically approved by Qin Ti Gai [1989]No. 3 from the Qingdao Municipal Reform Commission on March 24, 1989 to establish a joint stock limited company through targeted fundraising based on the reorganization of the Qingdao Refrigerator General Factory.

Note:Qingdao refrigerator general factory site

In 1985, Zhang Ruimin raided the warehouse and found 76 unqualified refrigerators in the warehouse.Therefore, Zhang Ruimin decided to open an on-site meeting for all employees and smash all 76 refrigerators in public, and the employees who produced these refrigerators personally smashed them. As a result, a sledgehammer, accompanied by the loud noises, really woke up the quality consciousness of the Haier people.

Note:In 1985, Haier people smashed 76 refrigerators to awaken Haier's awareness of quality

In 1988, Haier refrigerator won the first national quality gold medal.

On March 11, 1993, approved by the Qingdao Municipal Shareholding Pilot Work Leading Group Qinggu Ling Zi [1993] No. 2 and the China Securities Regulatory Commission Zheng Jian Fa Shen Zi[1993] No. 78, publicly issued public shares of RMB50 million to the public, raised funds of RMB369 million, so that the Company was changed from a targeted fundraising company to a social fundraising company. It was renamed Qingdao Haier Refrigerator Co., Ltd. on July 1, 1993. On November 19, Qingdao Haier Co., Ltd. listed on the Shanghai Stock Exchange(Stock Name: Qingdao Haier, Stock Code: 600690).

In the first half of 1996, an allotment plan of converting 3 rights shares for every 10 shares to 4 rights shares for every 10 shares was implemented with a placement price of RMB5.80 per share.

In 1997, an allotment plan of 3 rights shares for every 10 shares was implemented with a placement price of RMB6.80 per share; Haier Group Company transferred its shareholding in the Company's total share capital of 20.01% to its holding subsidiary Qingdao Haier Washing Machine Co., Ltd. ( Later changed its name to "Haier Electric International Co., Ltd."), which still holds a 35.08% stake in the Company.

In 1999, a allotment plan of 3 rights shares for every 10 shares was implemented, and the allotment price was RMB11.60 per share.

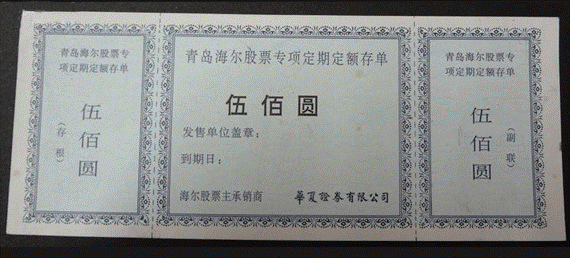

Note:Stock Certificate of the Company

2. Continuously integrating Haier Group's household appliance assets and becoming a bigger and stronger listed company .

Entering the new century, Qingdao Haier continues to move forward. As the household appliance business integration platform of Haier Group, it continuously promotes business integration and the construction of the Company's overall governance structure, gradually becoming the world's first brand of white goods.

In March 2000, Haier Group E-Commerce Co., Ltd. was established as a joint venture; in May, 98.15% equity of Zhangqiu Haier Electrical Engineering Co., Ltd. held by Haier Group Company was transferred.

In 2001, Qingdao Haier once again publicly issued 100 million shares with an issue price of RMB18 per share. In March, the Company acquired the 74.45% equity of Qingdao Haier Air Conditioning Co., Ltd. held by the Group, and after the completion of the acquisition , it held a total of 99.95% of its equity, and the air conditioning business further increased its strength; in May, the Company was renamed "Qingdao Haier Co. Ltd".

In 2002, the Company and the Group jointly invested to establish Haier Group Finance Co., Ltd., and the Company held 30% of its equity.

In 2006, the Company promoted the solution of inter-industry competition. The establishment of 42 sales branches to resolve domestic sales-related transactions and the establishment of its own independent sales platform has improved the Company's operating independence and made the operation of listed companies more standardized and transparent.

In 2007, completed the Directional Additional Issuance Project, issued Renminbi common share of 142,046,347 shares to Haier Group Company, acquired Qingdao Haier Air Conditioning Electronics Co., Ltd., Hefei Haier Air Conditioner Co., Ltd., Wuhan Haier Electric Co., Ltd. and Guizhou Haier Electric Co., Ltd. equity. The completion of the acquisition resolved the problem of horizontal competition between Qingdao Haier and four companies.

Since 2008, the Company has accelerated the pace of asset integration and successfully acquired 392,677,482 shares of Haier Electric Group Co., Ltd. held by Deutsche Bank, with a shareholding ratio of 20.01%.

In 2009, the Company further increased its holdings of 647,115,110 shares of Haier Electric Appliances, accounting for 31.93% of its total share capital. After the completion of the transfer (completed in 2010), the Company held 51% of the equity of Haier Electric Appliances in a cumulative manner, making it clear that it is the flagship of white goods of Haier Group strategic position.

In 2010, the Company integrated the Group's logistics business. Haier Group Company integrated the related logistics assets of its subsidiaries into Qingdao Haier Logistics, and after the completion of the integration of logistics assets, it transferred its 100% equity of Qingdao Haier Logistics to Qingdao New Goodaymart Logistics to build a combination of virtual and real. Goodaymart commercial circulation business platform has further clarified the positioning of Qingdao Haier and Haier Electric.

In the same year, the Company won the Listed Company Information Disclosure Award of Shanghai Stock Exchange.

In 2011, in order to further support Qingdao Haier to grow bigger and stronger, with the support of the Group, the Company issued a commitment to gradually reduce related party transactions and solve inter-industry competition within five years, which further provided a planning framework for improving the corporate governance structure.

In June of the same year, the Company completed the equity acquisition of 10 companies including Qingdao Haier Mould Co., Ltd., which is controlled by the Group, effectively reducing the related party transactions between the Company and the Group, and promoting the Company's sustainable and healthy development as a global leader in household appliances.

In May 2012, the third phase of the equity incentive plan was launched, and the plan was approved that month. In June, the Company's controlling subsidiaries and related parties of the Company subscribed to the financial company for capital increase in cash according to their respective shareholding ratios. In August,the Company launched the Qingdao Haier Co., Ltd. Shareholder Return Plan for the Next Three Years, which systematically guarantees Qingdao Haier investors to obtain a high level of return benefits and enjoy the results of the Company's value growth at a deeper level.In October, the Company invested in the construction of 5 million sets of fluorine-free frequency conversion, energy-efficient and environmentally friendly air-conditioning projects in Zhengzhou,China through the establishment of Zhengzhou Haier Air Conditioner Co., Ltd. (the specific name is subject to the approved name of the industry and commerce).

In October 2013, the Company issued a public announcement on the non-public issuance of A shares to KKR (Luxembourg), which was reviewed and approved by the General Meeting of the Company that month. In December, the Company's introduction of foreign investors was approved by the Ministry of Commerce of the People's Republic of China; the Company's holding subsidiaries and related parties of the Company subscribed to the financial company for capital increase in cash according to their respective shareholding ratios.

In 2014, the Company acquired R&D companies such as Hairi and Haigao, and realized the integration of R&D assets; in the same year, it acquired minority shares in four companies, including air-conditioning electronics, refrigerators, special refrigerators, and special freezers.

In 2015, the Company acquired the Group's overseas white goods assets, including 2 holding companies and 26 operating companies, and basically completed the global layout.

3. Introducing the world's top private equity investment institution KKR, and optimizing corporate governance.

In 2014, in order to better implement the networked and globalized development strategy and promote the Company's transformation into a platform enterprise in the Internet era, it introduced KKR, a world-class private equity investment agency, as a strategic investor of the Company through an open mind and equity cooperation.

4.Acquiring GE household appliance business and several overseas assets to enhance global competitiveness.

In June 2016, the Company basically completed the acquisition of GE household appliances business and assets, and further expanded its global business space.

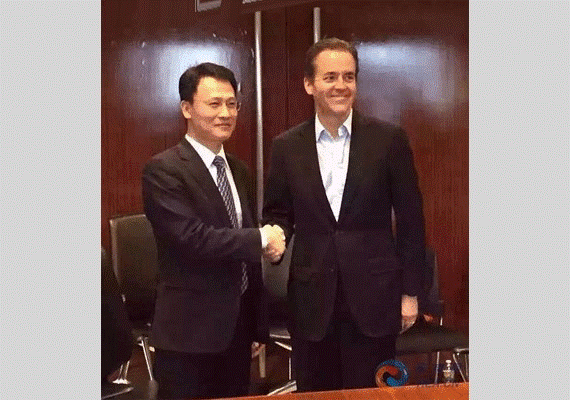

Note:On January 14, 2016, the Chairman of Qingdao Haier Liang Haishan(Left) signed a strategic cooperation agreement with GE representatives(Right).

In 2018, Qingdao Haier entered into a share purchase agreement to acquire all shares of the holding Company of Fisher & Paykel from Haier Group.

In 2019, Qingdao Haier Completes the Acquisition of Candy to Strengthen Global Leadership in Smart Home Appliances.

In 2019, Qingdao Haier officially changed its name into “Haier Smart Home”

In2020, Haier Smart Home completed privatization of Haier Electronics (stock code: 1169.HK) and achived initial listing in Hong Kong Stock Market.

English

English

中文

中文