Qingdao Refrigerator General Factory was established.

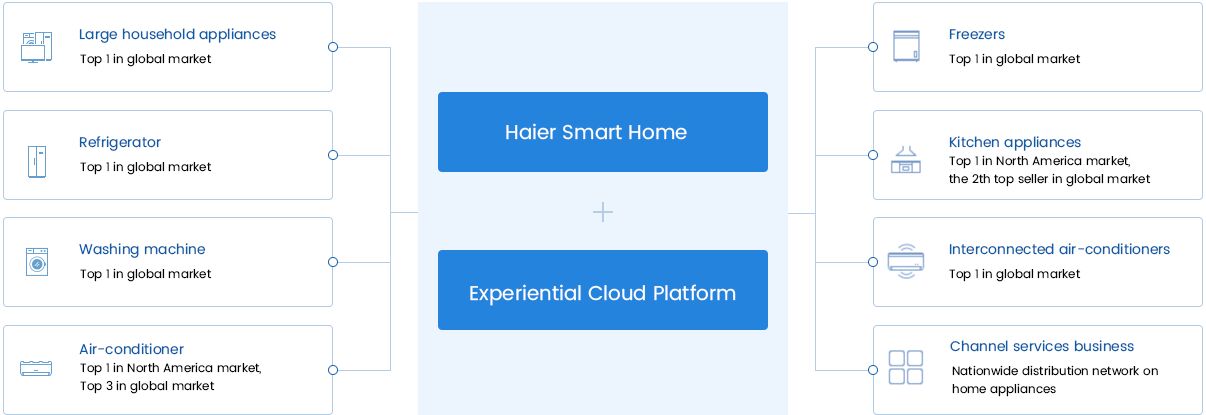

BUSINESS OVERVIEW

Source: Euromonitor, by retail sales volume, in 2019;China Market Monitor Co., Ltd. ("CMM"), by retail sales volume, in 2019.

COMPANY HISTORY

Learn more-

1984

-

1989

Qingdao Qindao Haier Co., Ltd. , our predecessor entity, was incorporated.

-

1993

The Company changed its name to Qingdao Haier Refrigerator Co., Ltd. and was listed on the Shanghai Stock Exchange(Stock Code:600690).

-

1996

In the first half of 1996, an allotment plan of converting 3 rights shares for every 10 shares to 4 rights shares for every 10 shares was implemented with a placement price of RMB5.80 per share.

-

1997

In 1997, an allotment plan of 3 rights shares for every 10 shares was implemented with a placement price of RMB6.80 per share; Haier Group Company transferred its shareholding in the Company's total share capital of 20.01% to its holding subsidiary Qingdao Haier Washing Machine Co., Ltd. ( Later changed its name to "Haier Electric International Co., Ltd."), which still holds a 35.08% stake in the Company.

-

1999

In 1999, an allotment plan of 3 rights shares for every 10 shares was implemented with a placement price of RMB11.60 per share.

-

2000

In March 2000, Haier Group E-Commerce Co., Ltd. was established as a joint venture; in May, 98.15% equity of Zhangqiu Haier Electrical Engineering Co., Ltd. held by Haier Group Company was transferred.

-

2001

The Company changed its name to Qingdao Haier Co., Ltd. after acquiring 99.95% of the air-conditioner business from Haier Group.

-

2002

In 2002, the Company and the Group jointly invested to establish Haier Finance Co., Ltd., and the Company held 30% of its equity.

-

2004

Haier became the only Chinese brand listed in the World's 100 Influential Brands.

-

2006

In 2006,the share reform plan was implemented.

-

2007

In May 2007, the implementation of the 2006 Directional Additional Issuance Project was completed: the Renminbi common share of 142,046,347 shares were issued to Haier Group to purchase its 75% equity in Qingdao Haier Air Conditioning Electronics Co., Ltd., 80% equity in Hefei Haier Air Conditioner Co., Ltd., 60% of the shares of Wuhan Haier Electronics Co., Ltd. and 59% of the shares of Guizhou Haier Electronics Co., Ltd. have been implemented.

-

2008

Qingdao Haier acquires a 20.1% interest in Haier Electronics.

-

2009

In May 2009, the first phase of equity incentive plan was launched; in September, the equity incentive plan was approved. In December, 647,115,110 shares of Haier Electronics were transferred, accounting for 31.93% of its total share capital. After the completion of the transfer, the Company held a total of 51% of Haier Electronics.

-

2010

Qingdao Haier started two transitions: (i) from a traditional business model to the Win-Win Model of RenDanHeYi; and (ii) from a traditional manufacturer to a user-centric service provider. Haier Group consolidated the logistics business into one of its subsidiaries. Qingdao Haier acquired a controlling interest in Haier Electronics, a Company listed on the Hong Kong Stock Exchange, and consolidated such controlling interest into Haier Electronics’s finance statement.

-

2011

Qingdao Haier became the top selling household appliances company in the world in terms of total global retail volume, achieving a global market share of 8.3%, according to Euromonitor. This was the first time a Chinese household appliance manufacturer achieved such a ranking. The sales of Haier's refrigerators and washing machines also ranked first in the world in terms of total global retail volume, with a global market share of 15.9% and 11.7%, respectively, according to Euromonitor.

-

2012

In May 2012, the third phase of the equity incentive plan was launched, and the plan was approved that month. In June, the Company's controlling subsidiaries and related parties of the Company subscribed to the financial company for capital increase in cash according to their respective shareholding ratios. In October, the Company invested in the construction of 5 million sets of fluorine-free frequency conversion, energy-efficient and environmentally friendly air-conditioning projects in Zhengzhou,China through the establishment of Zhengzhou Haier Air Conditioner Co., Ltd. (the specific name is subject to the approved name of the industry and commerce).

-

2014

Qingdao Haier's first interconnected factory commences operations.Qingdao Haier and Kohlberg Kravis Roberts & Co. L.P. ("KKR"), a leading global investment firm, announced the signing of a definitive agreement pursuant to which KKR acquired a 10 % stake in Haier, establishing a long-term strategic partnership.

-

2015

Qingdao Haier entered into a trust agreement with Haier Group, whereby assets held in Fisher & Paykel Appliances Holdings Limited were entrusted to Haier for operation and management. Qingdao Haier acquired Haier Group's overseas white goods business,including SANYO Electric's Japanese and South East Asian white goods businesses, thereby significantly expanding its global foot print. Qingdao Haier launched COSMOPlat for developing an industrial internet platform on mass customisation and intelligent manufac turing. Haier acquired a minority interest in Sanyo Electric Co., Ltd. Qingdao Haier acquired overseas white household appliances assets from Haier Group, including 26 operating companies and two holding companies

-

2016

Qingdao Haier completed its acquisition of General Electric Appliances (GEA).

-

2018

Qingdao Haier entered into a share purchase agreement to acquire all shares from Haier Group Fisher & Paykel Household Appliances Holding Limited.

Qingdao Haier D shares accomplished IPO in German Frankfurt Stock Exchange Market. -

2019

Qingdao Haier Completes the Acquisition of Candy to Strengthen Global Leadership in Smart Home Appliances;Qingdao Haier officially changed its name into “Haier Smart Home”.

-

2020

Haier Smart Home completed privatization of Haier Electronics (stock code: 1169.HK) and achived initial listing in Hong Kong Stock Market.

-

COMPANY STRATEGY

KEY FIGURES 2020

-

Country&District Coverage

160

-

Global R&D centers

14

-

Manafacturing center

122

-

210

¥bnOperating revenue -

203

¥bnTotal Assets -

Total number of staff

99,299

English

English

中文

中文